Institutional Traders Are Quietly Accumulating ALIT – Here’s Why That Matters

1. Bullish Signals in ALIT Options Market

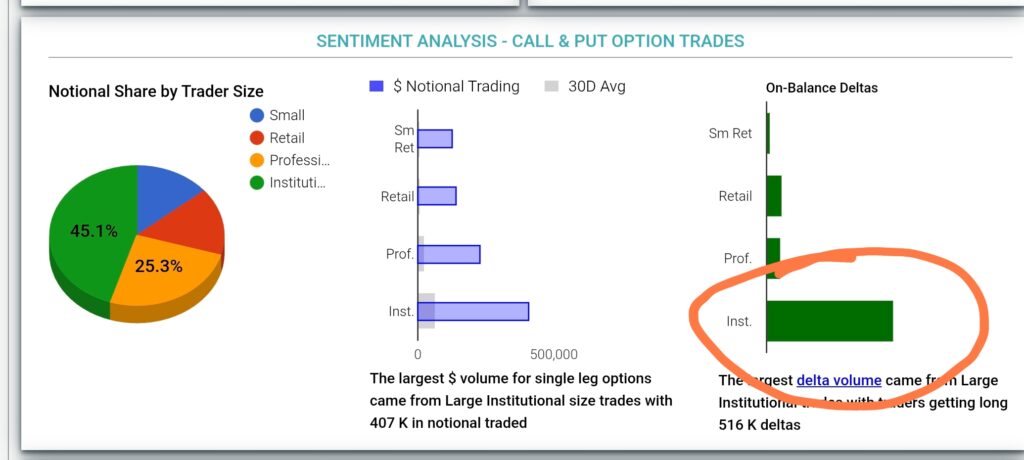

As of September 2, 2025, ALIT (Alight Inc.) has shown strong bullish sentiment in the options market. Data from Market Chameleon reveals:

- Net Option Delta Volume: +641,955 shares

- Bullish Pressure: +857,972 shares

- Bearish Pressure: –216,017 shares

- Bullish Average Entry Price: $3.88

- Bearish Average Price: $3.99

- Delta Volume vs Stock Volume: 5.4%

- Institutional Participation: 45.1% of notional volume

The majority of positive delta came from large institutional trades, with 516K deltas acquired — a clear sign of early positioning by smart money.

2. Technical Picture

- Current Price: $3.98

- 200-day SMA: $5.55 (long-term resistance)

- RSI: 39.5 (neutral, close to oversold)

- Price Action: Rebounded from $3.32 lows with increasing volume

3. Fundamental Overview & Valuation Multiples

| Metric | Value | Comment |

|---|---|---|

| Market Cap | $2.15B | Small-cap, potential for outsized moves |

| Enterprise Value | $3.85B | Indicates debt |

| P/S | 0.93 | Undervalued vs tech peers |

| P/B | 0.67 | Deep value, below book |

| P/FCF | 15.12 | Reasonable for software |

| Debt/Equity | 0.69 | Moderate leverage |

| Insider Ownership | 11.95% | Leadership has skin in the game |

| Institutional Ownership | 97.07% | Very high |

| ROE | –29.9% | Skewed by one-time impairments |

| EPS (ttm) | –2.16 | Includes goodwill write-down |

4. What’s Behind the Losses?

ALIT reported a $1.14B net loss in the latest quarter, mainly due to a goodwill impairment — a non-cash write-down related to overvaluation of past acquisitions. The 2021 purchase of Wipro’s cloud HR business expanded ALIT’s reach, but had to be revalued amid macroeconomic pressure.

Despite this, the company continues to generate stable revenue and positive free cash flow.

5. Why Institutions Are Buying

- P/B below 1

- Forward P/E only 6.23

- Stock down 60% from 3-year highs

- Sales remain stable (~$2.3B)

- Free cash flow is positive

ALIT is currently trading in a value zone with smart money entering quietly. This could be an early opportunity before wider sentiment shifts.

Conclusion

Alight Inc. shows signs of institutional accumulation and trades at deep value levels. While risks remain, the fundamentals suggest potential upside as operational performance stabilizes and one-time accounting items fade.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always do your own research or consult a licensed advisor.

Want more like this?

Subscribe to Tabiki Invest for weekly signals, stock breakdowns, and institutional flow insights.