Why MOMO Stock Might Be a Hidden Gem Before Earnings

MOMO (Hello Group Inc.), a Chinese-based social and dating app company, is quietly gaining momentum in the market. Backed by strong user engagement and now institutional attention, the stock could be on the verge of a breakout.

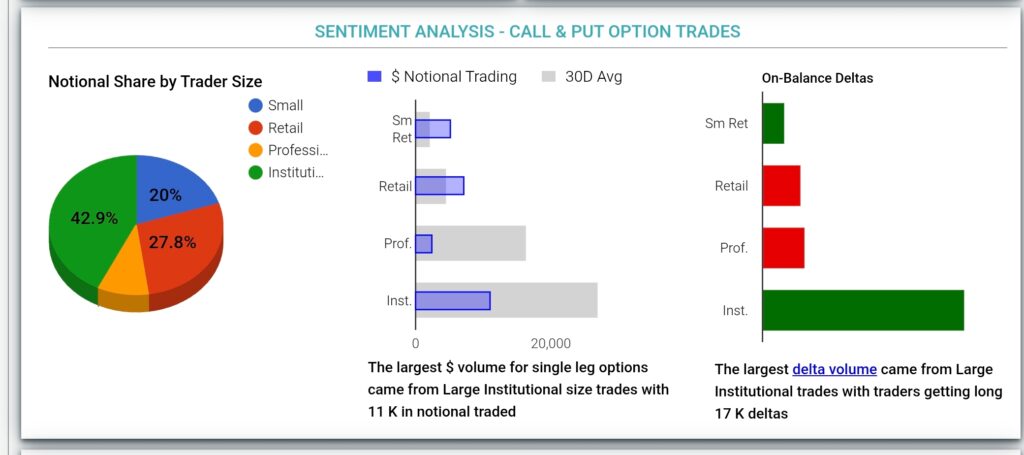

Institutional Activity Signals a Potential Breakout

In recent trading sessions, unusual options activity and sharp increases in bullish volume have been observed. Professional investors were the first to build positions, followed by a large institutional inflow on Friday — a combination that often precedes major upward movement.

This type of synchronized accumulation isn’t random. Smart money tends to move ahead of significant events, and all signs point toward anticipation of MOMO’s upcoming earnings report.

Earnings Report Scheduled for September 9

MOMO’s next earnings report is expected on September 9. Historically, the stock has shown strong performance during earnings cycles, with a win rate of over 80%. This creates a favorable short-term setup for swing traders and opportunistic investors.

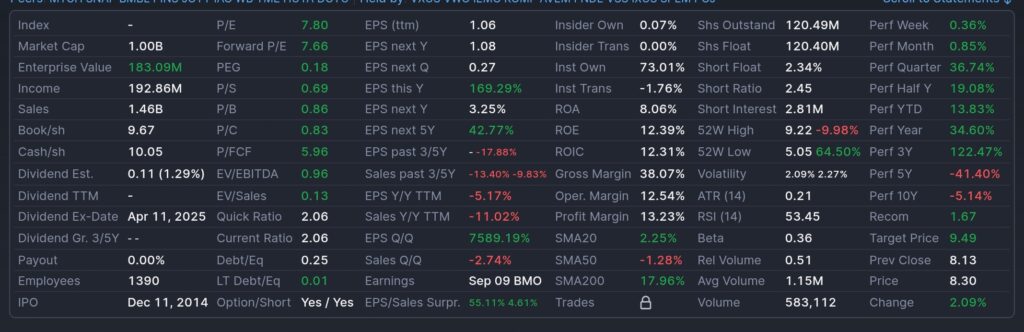

Strong Fundamentals Back the Technical Setup

Despite being a small-cap tech stock, MOMO has strong fundamentals. Its flagship apps — Momo and Tantan — maintain solid user bases across Asia. There’s also evidence of ongoing activity in untapped markets like Russia.

Both apps continue to monetize effectively through live streaming, virtual gifts, and video features. Engagement metrics remain high, showing that users are spending time and money inside the platform ecosystem.

No Dilution or Insider Selling

Shareholder-friendly indicators further reinforce the bullish case. There’s no recent history of share dilution or equity offerings, and insider transactions have remained quiet — suggesting leadership is confident in the company’s trajectory.

Conclusion: A Compelling Case for MOMO Stock

When you combine strong fundamentals, a bullish technical picture, and institutional buying ahead of earnings, MOMO stock looks like a compelling opportunity. With the potential for a short-term catalyst and limited downside dilution risk, it fits a classic “analyze, buy, chill” profile.

Investors looking for asymmetric opportunities may find MOMO to be one of the best setups this earnings season — if not the most overlooked.