Is ACDC the Next Big Move? A Deep Dive into a Promising Setup

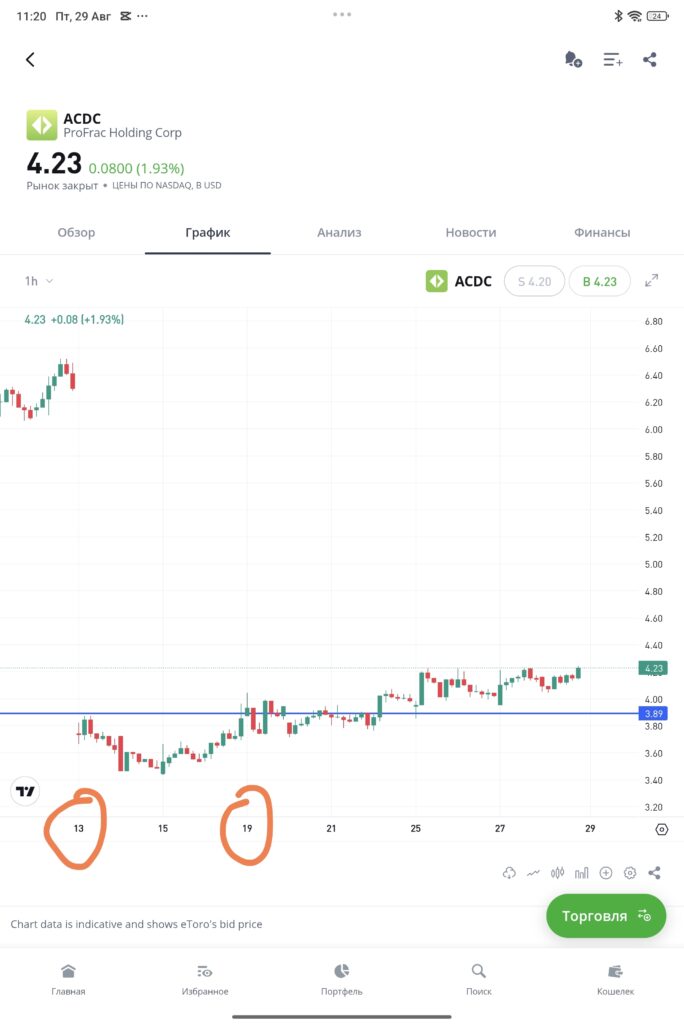

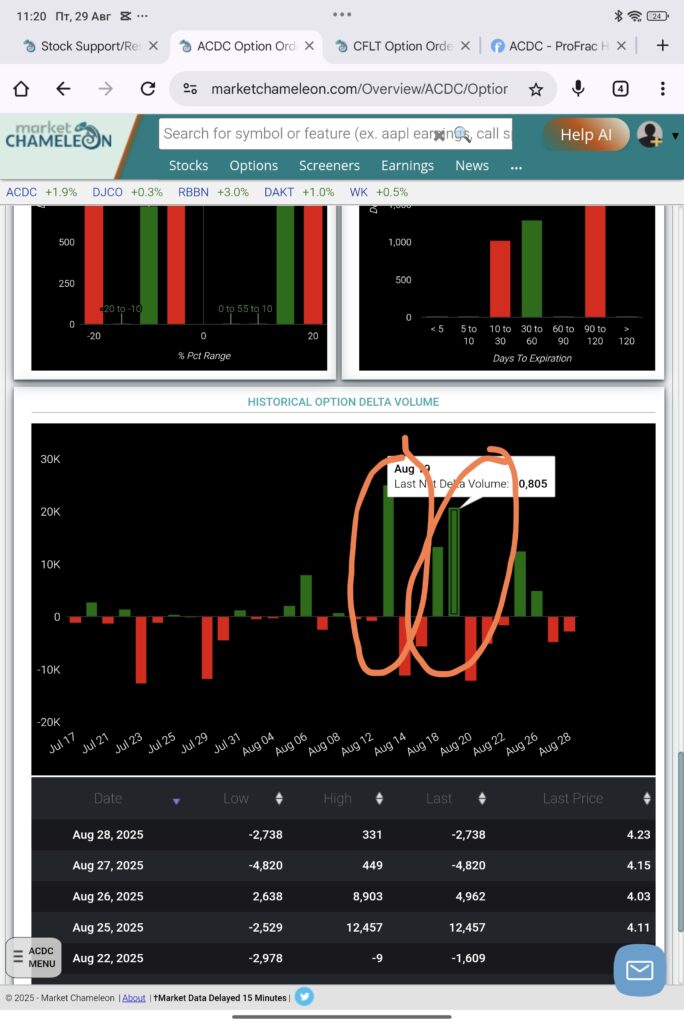

Recently, unusual activity surrounding ACDC has sparked the interest of professional investors. While the stock was trading relatively quietly, we noticed what appears to be serious accumulation on the equity side — without any corresponding spike in options volume. This suggests that the move is deliberate and not driven by short-term speculation.

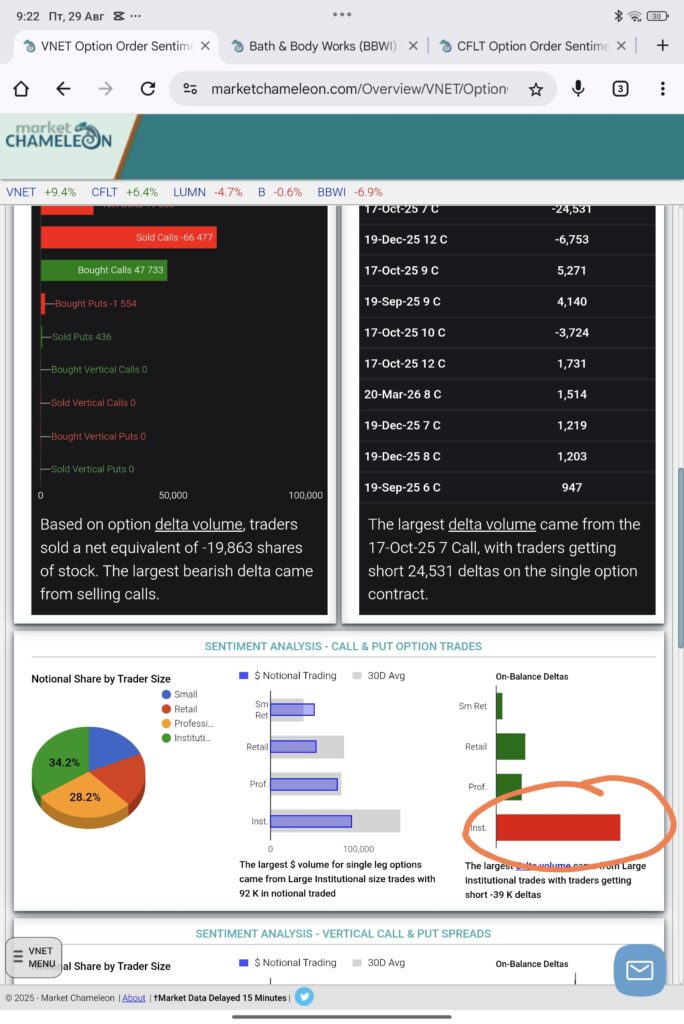

Strong Institutional Signals

What makes this case fascinating is the clear bullish bias of recent large-volume buyers. While retail traders may have overlooked it, institutional behavior hints at a potential upside catalyst. Judging by the structure and timing of these purchases, it’s likely that these are not random inflows, but rather calculated entries by informed players.

Upcoming Earnings Report

Adding fuel to the fire, ACDC is expected to release its earnings report tomorrow (August 30), which could become the primary trigger for a breakout. If the results are in line with or beat expectations, it could validate the current accumulation and push the price significantly higher.

SWOT Analysis

Strengths

- Clear signs of accumulation by large players

- Upcoming catalyst in the form of an earnings report

- Low float and high responsiveness to volume

Weaknesses

- Lack of clear fundamentals (depending on latest report)

- Still under the radar — limited media or retail attention

Opportunities

- Potential breakout if earnings are strong

- Momentum traders may pile in if the chart moves fast

- Growth potential if institutional involvement continues

Threats

- If earnings disappoint, the price may fall back rapidly

- Any offering or dilution could suppress momentum

- Low volume during pullbacks may lead to high volatility

Business Overview

ACDC operates in the electrification and energy tech space, which has long-term tailwinds. However, the company is not yet profitable and CAPEX remains high. There’s always a risk of equity dilution, although no immediate offering has been announced.

Leadership and Strategy

Management has been stable, with no major changes recently. Their strategy includes expanding partnerships and scaling manufacturing — which may explain the increased spending and need for capital.

Final Thoughts

With clear signs of institutional positioning, an imminent earnings report, and a bullish technical setup, ACDC deserves attention. While not without risk, the upside potential for short-term traders and swing investors is significant.

As always, this analysis is available in full for our premium subscribers at TabikiInvest.com. Stay ahead of the crowd — join today and get access to signals the pros are watching.