Why I’m Not Buying OPEN, Despite the Recent Hype

At first glance, Opendoor (OPEN) shows an attractive rebound. The chart looks tempting, and the stock has seen a lot of buying interest in recent days.

But let’s take a closer look.

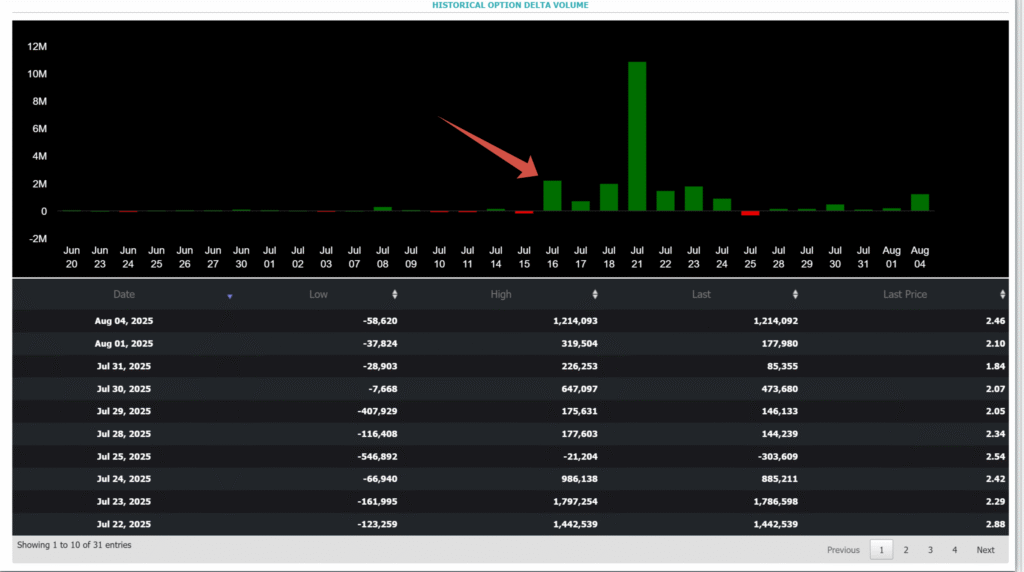

On July 16, there was a strong signal. Option delta volume exceeded 1.2 million shares, and it appeared that institutional and professional traders were entering. That was when the main move began. Definitely interesting.

However, as of today, the structure of the flow has changed. According to recent data from Market Chameleon, the majority of option buying is now coming from retail traders. In the notional share breakdown by trader type, retail participants account for over 63 percent of the total options volume.

This is not the type of signal I look for. While the crowd jumps into the hype, professionals have likely already taken their profits. The market tends to work this way — retail traders often arrive late, and this is clearly reflected in both the chart and the option flow.

Conclusion: interest in OPEN made sense in mid-July. Today, it’s just the echo of a move that’s already played out. I don’t buy stocks when the crowd shows up. I watch those who played early.